Accumulated depreciation formula

Using the straight-line depreciation method we see that the equipment will be depreciated by 1000 each year. At the end of the fifth year the accumulated depreciation amount would equal 112500 or 22500 in yearly depreciation multiplied by five years.

Accumulated Depreciation Definition Formula Calculation

Read more about Bank reconciliation statement.

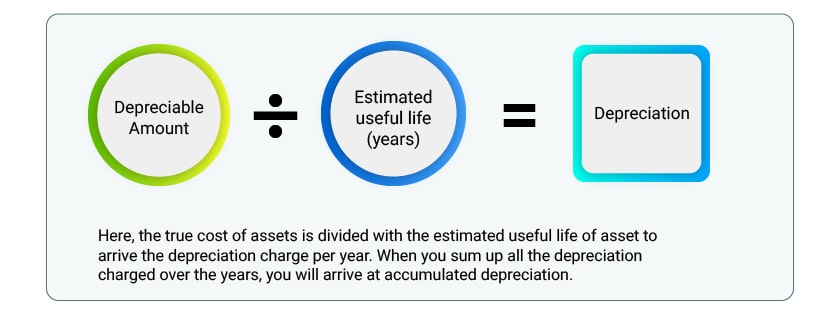

. For the next of years we apply the same percentage on the booked of written down value of the asset but the value of the percentage is not given in the data we have. For accumulated depreciation the formula is. Accumulated depreciation is usually calculated from month to month.

But we can calculate it. Depreciation Asset Cost Residual Value Life-Time Production Units Produced. Accumulated depreciation Depreciation expense Depreciated amount.

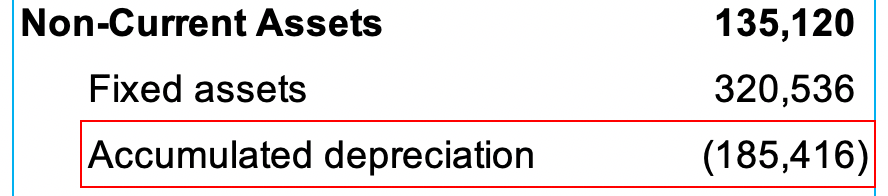

It is a cumulative total of the. Accumulated Depreciation Ratio Accumulated Depreciation Total Gross Fixed Assets. The straight-line depreciation method basically will show.

Simple formula for accumulated depreciation. DB Annual depreciation expense Original cost of asset - Accumulated depreciation Depreciation rate Year 1 depreciation expense 35000 - 0 20 Year 1. Annual Accumulated Depreciation Asset Value Salvage Value Useful Life in Years.

Annual Depreciation Purchase Price Salvage Value Years in Useful Life. There are several methods you can use when determining how to calculate the accumulated depreciation formula. Depreciation Expense 2 x Basic Depreciation Rate x Book Value.

Depreciation expense in the. It is a contra-asset account a negative asset. Depreciation Asset Cost Residual Value Useful Life of the Asset.

There are several methods you can use when determining how to calculate the accumulated depreciation formula. The accumulated depreciation ratio formula is calculated like this. Imagine Company ABC buys a building for 250000.

Divide the difference by. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use. After having all the values in hand we can apply the values in the below formula to get the depreciation amount.

Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD. Accumulated depreciation and net book value at the end of the third year. Book value Cost of the Asset Accumulated Depreciation Step 3.

The formula for calculating the accumulated depreciation on a fixed asset PPE is as follows. Accumulated Depreciation Cost of the Asset - Salvage Value Life of the Asset Number of Years We already know the. Here is the formula for calculating accumulated depreciation using the double-declining balance method.

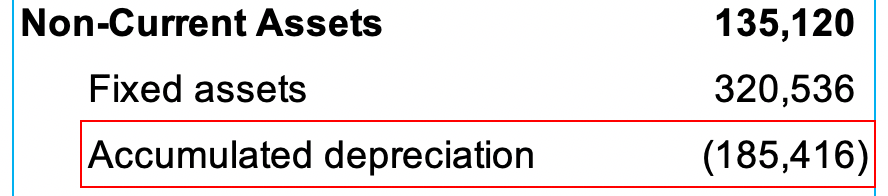

The building is expected to be. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Accumulated depreciation is usually calculated from month to month so.

Accumulated Depreciation Formula Accumulated Depreciation Cost of Fixed Asset.

Fixed Assets Accumulated Depreciation Formula Calculation Financial Learning Class

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition How It Works Calculation Tally

Accumulated Depreciation Calculator Download Free Excel Template

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Overview How It Works Example

Accumulated Depreciation Calculation Journal Entry Accountinguide

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Expense Double Entry Bookkeeping

Accumulated Depreciation Explained Bench Accounting

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Definition Formula Calculation

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

What Is Accumulated Depreciation How It Works And Why You Need It

Accumulated Depreciation Msrblog

Depreciation Formula Examples With Excel Template